What is Capital One known for?

There are a few outstanding characteristics of Capital One that you should know from the onset. They include:

- It is mostly known as an online bank.

- Its credit cards are well-known and have been advertised much – Savor, Venture, Platinum, and quicksilver.

- It is among the ten largest banks in the country.

- It has had only one CEO since it was founded in 1994, Mr. Richard Fairbank.

- Its accounts charge zero monthly fees.

Checking

Checking accounts are used to make daily transactions. At Capital One, you get:

- Free foreign transactions.

- Zero monthly fees.

- Early direct deposit, meaning you can get your paychecks two days earlier than scheduled.

- Capital One has over 70,000 ATMs globally that are free to transact from.

- They compound your interest daily but charge it to your account monthly.

- No initial deposit is required to open your account.

- 0.10 Annual Percentage Yield.

- MasterCard debit card.

- You can check your deposit and balance online.

- You get your first checkbook for free.

Savings

A savings account allows you to save while still earning interest on the money you save. Your savings account at Capital One provides for this:

- No initial deposit is required.

- No minimum account balance.

- There is no monthly fee for this account.

- The interest rate is higher than for most banks.

- Interest is compounded daily and then paid every month.

- An Annual Percentage Rate of 1.75%.

- You can save money automatically.

Capital One offers two savings accounts: 360 Performance Savings Account (1.75% APY) and the Kids Savings Account (0.3% APY). For the kids' savings account, both parents and kids can access the account until the child turns 18, and the account is changed to a 360 Savings Account by default.

Certificate of Deposit (CD)

A certificate of deposit allows you to save a fixed amount of money in a bank for a specified time. This money will earn interest. CDs will earn the same APY or interest over the time set. It is assumed that you will not need to make withdrawals to your CD account, which is what sets it apart from a typical savings account.

With Capital One, you get:

- Timeframe of between six and sixty months (that is, five years).

- No initial deposit is required.

- You may only open a regular term CD with Capital One.

- Interest is compounded.

- All your money is FDIC insured, as with all other money you transact with Capital One.

- Average APY of between 1.65% and 3.25%.

- Low penalties for early withdrawals.

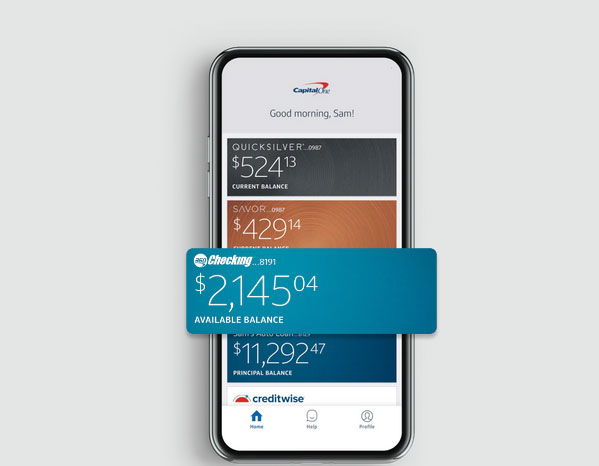

Mobile Banking

The Capital One mobile app is currently one of the highest-rated mobile apps, with 24/7 accessibility and access to all features. With the app, you can:

- View, access, and manage your deposits and balances.

- Lock and unlock your Mastercard debit card in your Capital One 360 Checking account.

- Make deposits by using your smartphone's camera. You only need to take front and back photographs of the check you are depositing into your account. All from the comfort of your home. The money is usually made available on the next business day.

- Easy and seamless money transfers to family and friends. Just download Zelle ® and follow the prompts.

Capital One Cafés

Perhaps one of Capital One Bank's bestselling features is that the cafés are open to members and non-members. You get your much-needed coffee break (and snacks!) to kick start your working day. What's even better? You get your corner to work from with free Wi-Fi.

These spaces are not just for fun and relaxing. You can make your Capital One inquiries from the available ambassadors at your café of choice. Some of these include auto loan inquiries, managing your checking and savings accounts, withdrawing cash through the available ATMs at the café, and investing yourself into a money and life program.

Credit Cards and Rewards

Different Capital One credit cards provide different rewards to their holders. The number of credit cards offered by Capital One is numerous; hence, finding the right card for you may be a bit challenging, but once you do, it will be tailor-made for your needs. The table below best compresses your options:

Card | Annual fee | Purchase rate | Transfer APR fee | Credit |

Platinum Mastercard ® | $0 | 26.99% variable APR | $0 for 26.99% APR | Fair |

Venture X | $395 | 18.49 – 25.49% variable APR | $0 for 18.49-25.49% APR | Excellent |

Venture | $95 | 17.49 – 25.49% variable APR | No transfer fee for 17.49 – 25.49% APR | Excellent |

VentureOne | $0 | 0% APR for 15 months 16.49 – 26.49% APR after 15 months | 0% APR for 15 months 16.49 – 26.49% APR | Excellent |

Quicksilver | $0 | 0$ intro APR 16.49-26.49% APR after 15 months | 0% APR for 15 months, 16.49 – 26.49% APR after 15 months | Excellent |

Savor | $95 | 17.49 – 25.49 % variable APR | $0 for 17.49 – 25.49% APR | Excellent |

Platinum Secured | $0 | 26.99% variable APR | $0 for 26.99% APR | Rebuilding |

Quicksilver Rewards for Good Credit | $0 | 26.99% variable APR | $0 for 26.99% APR | Good |

Customer Care

Most Capital One clients are happy with the service they receive from the bank, whether online or in physical bank locations. It has an A rating with BBB.

For inquiries, you can contact 1-877-383-4802 any day of the week from 8 a.m. to 11 p.m. EST. There is also an interactive forum with other clients where you can chat with Eno, the official Capital One digital assistant. Their website provides help in all areas, such as loans support, foreign accounts, and online accounts. Using their website links is faster than calling them.