Introduction

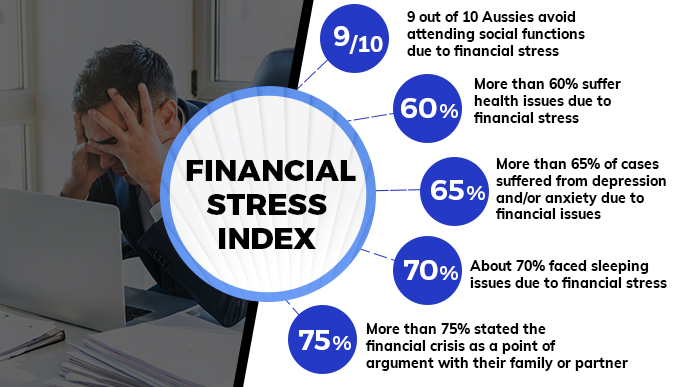

The last few years have brought no relief from economic constraints, what with a global pandemic, the greatest inflation rate in 40 years, and the possibility of a recession. Nearly everyone has felt the mental toll of these bleak economic times. Concerns about money have a detrimental effect on the mental health of 42% of adults. Women and those with lower incomes are disproportionately represented in that group.

Anxiety, insomnia, and a general lack of confidence about one's future are all symptoms of financial stress. There are ways to alleviate financial stress and take control of your financial future, even if most of the causes can't be controlled. Here are seven strategies if you're having trouble dealing with financial stress.

Save Money

Create and maintain a regular savings routine if at all possible. Do your best to start following a plan, no matter how simple, if you don't already. A savings plan and sticking to it adds another variable over which you have complete command. You'll feel less stressed and more accomplished if you save money. Having some cash aside in an emergency is also a great stress reliever.

Identify Your Financial Stressors And Make A Plan

Assess your current financial status and how it is causing you stress. Jot down savings strategies you and your family can implement or better methods to handle your finances. Then settle on a strategy and check in on it frequently. Short-term, this may increase concern, but long term, the benefits of planning and sticking to it will become apparent. Call your bank, utility, or credit card company to arrange a payment plan if you need assistance paying bills or managing your debt.

Be Strategic About Reducing Debt

Having too much debt on credit cards is a common source of anxiety about money. It's not just pricey; it can also prevent you from saving money. Anxiety relief: a strategy for paying off the debt. The high-rate strategy (where you pay off the card with the highest interest first) or the snowball method (where you pay off the card with the smallest balance first) are two options to consider if you have many cards with outstanding balances (concentrating on the cards with the highest interest rates first).

- A minimum payment must be made on all credit cards.

- It's important to commit to one method of payment.

- Don't rack up more debt by using your credit cards.

Take Inventory Of Your Finances

Bills left unopened, phone calls from creditors ignored, and credit card and bank records disregarded may all add to the stress of making ends meet. However, refusing to accept your predicament's truth will only worsen matters. Keeping track of your income, debt, and expenses for at least a month is the first step in developing a strategy to address your financial issues.

You can either plan ahead by using one of many available websites or smartphone apps, or you can inspect past bank and credit card statements and receipts to get a sense of your financial situation. Taking stock of your financial situation can give you a clearer understanding of where you are, regardless of how easy or difficult your particular financial predicament may be. And as scary or terrible as it may be, keeping careful financial records can give you back some much-needed control over your life.

Recognize How You Deal With Stress Related To Money.

Some people may find harmful coping mechanisms like smoking, drinking, gambling, or emotional eating more appealing during economic hardship. Stress can also increase the likelihood of fights and conflicts occurring between spouses. A psychologist or community mental health clinic may be able to help if you notice any of these behaviors causing you distress.

Build An Emergency Fund

Having some savings put up in case of an unexpected expense, like a broken car, a loss of income, or a serious sickness, can be a huge relief. Although having an emergency fund of three to six months' worth of living expenses is a good goal, it cannot be easy to accumulate that kind of money. Don't worry too much about how much you can put away each week; what's crucial is that you are consistently doing so.

- When you've accounted for everything on your needs list and created a monthly budget, you'll know how much you can put away.

- Building an emergency fund of three to six months' worth of costs should come first before considering saving for the future.

- Do regular transfers from your checking to your savings.

Conclusion

While a quick remedy to your money woes is probably not in the cards, you can immediately begin laying the groundwork for future success. Your financial woes are simply one source of the stress you're feeling; prioritizing your health and well-being can help, too.