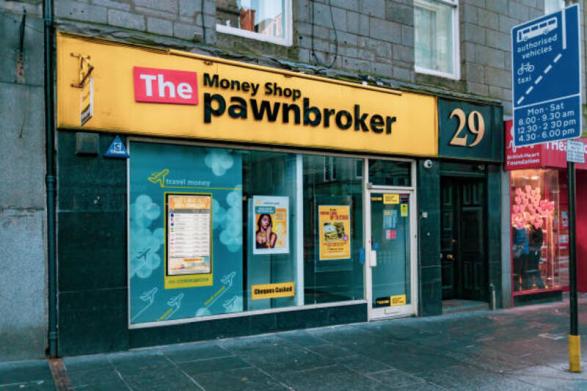

If you're looking for an accessible and efficient form of short-term financing, a pawnshop loan may be your best bet. Pawnshop loans are quick, easy to obtain loans that allow customers to use one or more items as collateral in exchange for cash. Typically offering higher interest rates than traditional banks without requiring a credit check makes pawnshop loans an attractive option for those facing financial difficulty. In this guide, we'll explain the specifics of how pawn shop loans work and give you valuable insight into understanding their advantages and disadvantages so that you can make the most informed decision possible.

What is a Pawnshop Loan and How Does it Work?

Are you in a tight spot and need some quick cash? Pawnshop loans might be able to help you out. A pawnshop loan is a type of secured loan where the borrower puts up an item of value as collateral in exchange for a cash loan. The amount of money you can borrow will depend on the value of the item you provide. The pawnshop will hold onto your collateral until you pay back the loan in full, including any interest and fees that may apply.

If you cannot pay back the loan, the pawnshop will keep your collateral and may sell it to recoup their losses. Though pawnshop loans may not be the most ideal option, they can provide a lifeline in times of need.

Things to Consider Before Taking out a Pawnshop Loan

Considering a pawnshop loan can be a convenient way to get fast cash when you need it most. However, before you go ahead with this option, there are a few important factors that you should keep in mind.

- Make sure you understand the terms of the loan, including the interest rates and any fees that may be associated with it.

- You should also consider whether you are comfortable with using your valuable possessions as collateral, as you risk losing them if you cannot repay the loan.

- It's important to shop around and compare offers from different pawnshops to ensure you are getting the best possible deal.

By taking the time to consider these factors carefully, you can make an informed decision about whether a pawnshop loan is the right choice for your circumstances.

What Can Be Used as Collateral for a Pawnshop Loan?

When faced with a financial emergency, people often turn to pawnshops for quick cash. However, securing a pawnshop loan requires collateral. The good news is that there are a variety of items that can be used as collateral. Jewelry, such as rings and necklaces, is a popular choice due to its high value in a small package. Electronics, like laptops and smartphones, are also common collateral items.

Other items, such as musical instruments, power tools, and firearms, can also be used to secure a pawnshop loan. Just be sure to choose an item with a value that meets or exceeds the amount of the loan you need.

Alternatives to Pawnshop Loans:

When you need quick cash, pawnshop loans may seem like an easy solution. However, they often come with high-interest rates and the risk of losing your valuable belongings if you can't repay the loan. Fortunately, there are alternatives to pawnshop loans that are more financially responsible and won't put your possessions in jeopardy. Personal loans from banks or credit unions typically come with lower interest rates and more flexible repayment options.

You can also consider borrowing from family or friends, or selling unwanted items online or at a garage sale. Don't let a pawnshop loan put you in a bind - consider these alternatives for a safer and smarter financial solution.

Tips for Shopping at a Pawn Shop

If you do decide to go ahead with a pawnshop loan, there are a few tips you should keep in mind when shopping at a pawn shop.

- Be sure to inspect items carefully before making an offer or purchase.

- Ask the store about any warranties they may offer on items for sale.

- Conduct research about the value of items you plan to pawn or buy.

- Make sure the store is licensed and reputable.

Shopping at a pawnshop doesn't have to be intimidating - following these tips can help ensure you get the best deal possible on the items you need.

Conclusion:

Pawn shop loans can be a great way to get fast access to the money you need without having to apply for a bank loan. However, it's important to remember that taking out a loan from a pawnshop carries certain risks and should be considered carefully before proceeding. Research potential pawn shops ahead of time to make sure they're reputable and understand what kind of collateral works for different items.

Additionally, consider if there are alternatives such as title loans or selling items outright as these could prove more advantageous than taking out a pawn shop loan. With the right knowledge and preparation, you'll be more likely to make the best decision when it comes to deciding whether or not a pawn shop loan is right for you.

FAQs:

Q. How much can I borrow with a pawnshop loan?

A. The amount of money you can borrow with a pawnshop loan will depend on the value of the item(s) you use as collateral.

Q. Is it safe to shop at a pawn shop?

A. Yes, as long as the pawnshop is licensed and reputable. Be sure to conduct research about the store before making any purchases or taking out a loan.

Q. What items can I use as collateral for a pawn shop loan?

A. You can use jewelry, electronics, musical instruments, power tools, and firearms as collateral when securing a pawn shop loan. Additionally, the item must have a value that meets or exceeds the amount of money you need to borrow.