Writing a check to yourself may seem like an odd request, but it is quite simple and useful for managing your finances.

To many of us, writing checks conjures up memories of simpler times when physical checks were the primary means of money exchange rather than email transfers or debit card payments.

But if you need to transfer money from one bank account to another, it's still possible (and often more secure) to do so by writing a check — even if both accounts are in your name.

In this blog post, we'll show you how to write a check to yourself and provide other helpful advice on safely depositing funds into your bank account.

Understand The Basics Of Check Writing

Writing a check to yourself isn't as uncommon as you might think. It's an easy and efficient way to move money between accounts, especially if both are in your name. Here are the basics of writing a check to yourself and other helpful advice for safely managing your finances.

When writing a check, be sure to include all necessary information such as the date, payee name, amount written in numbers and words, signature line (for yourself), memo field (optional), and account number (if needed).

Furthermore, make sure that the spelling of your name is identical on all accounts involved. This ensures that the transaction will go smoothly with no hiccups along the way. Additionally, it's important to keep a few security measures in mind.

Be sure to sign the check with your legally recognized signature and not make any alterations. Writing "void" or "for deposit only" on the check's memo line also helps to ensure that funds cannot be diverted to another account. It's also important to remember that checks need to clear before you can access the money in your account. This can take several days, depending on the type of check written.

Writing a check is an efficient way of transferring money between accounts; however, there are some drawbacks associated with it as well. For instance, physical checks can get lost or stolen if not properly handled and stored securely. Additionally, many banks limit how much can be transferred via check and may charge additional fees.

How Do You Write a Check to Yourself

Gather the Necessary Materials

Writing a check to yourself requires gathering some materials first. You'll need your bank account number, routing number, and checkbook. Depending on your bank, you may need additional information, such as an account nickname or username.

Additionally, ensure you have your driver's license (or other government-issued photo ID) handy for verification.You'll want to ensure all this information is correct and up-to-date before writing the check; otherwise, it could be returned for insufficient funds or other errors.

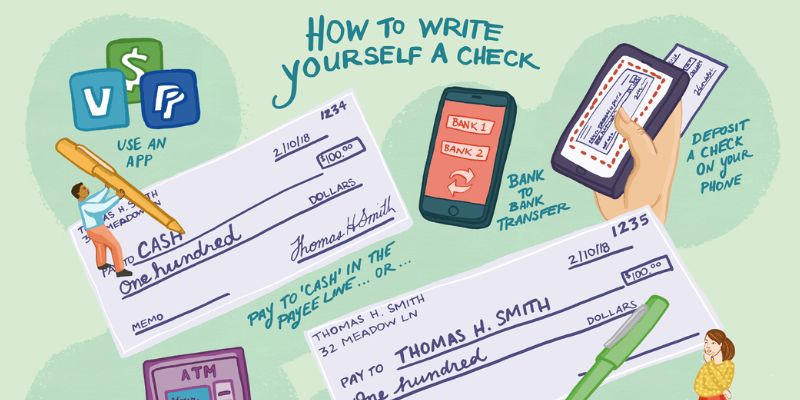

Once everything is in order, fill out the date section using today's date and write "Self" in the "Pay To The Order Of" line with an amount written numerically and spelled out in words. Then, sign the check and record the transaction in your checkbook register for future reference.

Fill out the Check

- Once you have all the necessary supplies, it's time to fill out the check. Start by writing 'Pay to the Order of' followed by your name in the top line.

- Enter your account number and any other required information on the second line, such as an address or phone number.

- Finally, on the third line, write how much money you want to be transferred and sign it on the bottom right.

Sign the check

It is important to note that all checks must be signed to be valid. The signature must match that on file with your bank or financial institution. It would also help to use the same name or initials as those listed on your identification documents.

When signing the check, you should sign your full legal name on the line provided. You can also include additional information, such as your telephone number or address. This extra information is unnecessary but can help ensure the check reaches you safely and securely.

Record The Check-In Your Financial Records

Writing a check to yourself is an easy way to transfer money from one bank account to another, and you must record it in your financial records. Keeping track of any checks you write to yourself will help ensure accuracy when calculating your finances.

It's best practice to notate the date, the amount, and the purpose of each check in a ledger or log book. This helps keep track of all funds transferred between accounts and ensures that everything is noticed during accounting tasks.

You can also note the identification number on the bottom right corner of every check — this can be used for verification if needed.

Make sure to note these details accurately; otherwise, you may find yourself facing some unpleasant financial issues. With accurate records, you'll have an easier time managing your finances and staying on top of all the money that comes in and out.

Writing a check to yourself can be useful for managing your finances — ensure you record it accurately too! That way, you can stay up-to-date with your banking activity and take control of your financial future.

Deposit or cash it

Writing a check to yourself is often the most secure way to transfer money from one bank account to another – even if both accounts are in your name. Once you've written the check, you must decide how to deposit or cash it. It's important to remember that there are several different ways to do this; each option has benefits and drawbacks.

If you want immediate access to funds deposited into your other bank account, cashing the check at a teller window is the quickest option. However, it may be subject to certain fees from both banks involved and a waiting period for funds clearance.

Alternatively, you can deposit the check directly into your other bank account via ATM or online. While this method may take a few days for the funds to appear in your account, it typically does not require fees for cashing or depositing the check.

Regardless of your chosen approach, keep track of all receipts and confirm that your deposits were processed correctly. This will ensure your finances are secure and both bank accounts are up-to-date.

FAQs

Can you write a check to yourself and cash it?

Yes, you can write a check to yourself and cash it at most banks or credit unions. Depending on the institution, you may need to provide identification when cashing the check. Additionally, some institutions may charge additional fees for cashing such checks.

Can someone else cash my check written to me?

No, only the person named as the payee can legally deposit or cash a check written out to themselves. If you want to transfer funds from one account to another in your name but not directly written to yourself, consider using an electronic fund transfer system instead of a physical check.

Can you write a fake check to yourself?

No. Writing a fake check is illegal and punishable by law. Additionally, banks can detect fraudulent checks quickly, so attempting to write a false check yourself is unlikely to be successful.

Conclusion

Writing a check to yourself is an easy way to transfer money between bank accounts — even if they are under your name. But it's important to ensure all the information is correct and up-to-date before writing the check, as incorrect or missing information can lead to delays or even a returned check. Also, remember to use the same name and signature on both accounts; note down the transaction in your financial records for easy reference in the future. Following these steps carefully and double-checking everything, you can safely transfer funds between bank accounts without any trouble or risk.