-

Mortgages

MortgagesDescribe PMI. The Operation of Private Mortgage Insurance

When a borrower puts down less than 20% on a property, conventional mortgage lenders typically require them to obtain private mortgage insurance (PMI). Private mortgage insurance (PMI) is insurance for the lender against the borrower's default on a house loan.

Feb 13, 20249845 -

Mortgages

MortgagesApply for a Guarantor Loan

Your prospects of obtaining financing could be improved by applying for a guarantor loan; nevertheless, you and the guarantor need to be aware of the potential hazards. We look at how to apply it and the factors that should be considered.

Feb 01, 20244609 -

Investment

InvestmentLow-Risk Dividend Stocks to Buy

Even if growth and technology stocks had significant declines during the bear market of 2022, investors no longer have to limit themselves to just those two categories. If an investor wants to decrease the amount of volatility their portfolio is exposed to, one option they have is to look for "boring" stocks in defensive industries like consumer staples, utilities, and health care rather than "flashy" stocks that capture the attention of the headline writers.

Dec 09, 20238618 -

Banking

BankingFive Steps to Opening a CD Account

The term "CD" refers to a specific kind of savings account called a "certificate of deposit." You put money in the account and pledge not to touch it for a while. After that period of time has passed, you will get your initial deposit plus any interest that has accrued.

Oct 27, 20231846 -

Mortgages

MortgagesHow to Use Student Loans for Living Expenses: An Ultimate Overview

You can use your student loan money for anything you need, including necessities like food, shelter, and transportation while you're in school. However, student loans include purchasing restrictions.

Feb 25, 20246605 -

Banking

BankingAll About CDs

Instead of a bank or credit union, a brokerage may provide a Certificate of Deposit (CD) account. The initial investment required for these CDs could be greater than that for regular or specialised CDs. In some cases, such as when opening a new one, you may need to invest $10,000 or more. In comparison to bank CDs, returns on broker CDs may be substantially higher due to their liquidity on the secondary market.

Feb 23, 20244434 -

Know-how

Know-howTeach Kids About Charity

Children being taught compassion and charity at an early age may pave the way for them to become more collaborative and polite as adults.

Feb 21, 202491 -

Know-how

Know-howWhat Is Supplemental Health Insurance?

With health insurance, you won't have to worry about paying out of pocket for things like checkups, procedures, medicines, and emergency treatment. Although many policies provide extensive protection, medical insurance won't pay for everything that might arise if you become sick. Health insurance supplements might help bridge the financial difference. Supplemental health insurance, as its name implies, is meant to be used in conjunction with another health insurance policy. These additional coverage options are not a substitute for primary medical coverage. Dental, vision, and long-term care insurance are specialized insurance that may aid with out-of-pocket medical expenses. Extending basic medical insurance coverage, supplemental policies pay for medical expenses not included in basic medical coverage.

Oct 23, 20237179 -

Know-how

Know-howLearn and Understand: How to Deal With Financial Stress?

Those who are concerned about their financial stability are not alone. Adults in the United States often feel anxious about financial matters. And yet, a whopping 72 percent of Americans say they regularly experience financial stress due to things like anxiety about making mortgage payments or feeling overwhelmed by their debt loads. Given the extensive list of diseases associated with financial stress, this is a fairly big deal.

Dec 29, 2023922 -

Know-how

Know-howCan A Seller Keep The House Deposit From A Buyer?

When can sellers keep earnest money? Is another way of asking how a buyer can lose their eager money? Most real estate transactions necessitate some good faith deposit or earnest money from the buyer. The normal earnest money figure is one to five percent of the total transaction price. The earnest money deposit might be as high as 10% when purchasing the brand-new building. The real estate business marketing the property will normally keep the earnest money in an escrow account until the sale is finalized. The deposit funds, however, may be held in escrow by a title firm, real estate attorney, or other specified escrow agency. The homebuyer's earnest money deposit guarantees the buyer fulfills their obligations under the contract.

Jan 23, 20243091 -

Investment

InvestmentA Nursing Home

Adult daycare is a further alternative to staying at home. This option is quite similar to assisted living; however, instead of living in a residential facility, you live in your own home or with a member of your own family and check into a care facility for the whole day or a part of it

Nov 22, 20236935 -

Know-how

Know-howWhat Is Construction Interest Expense? A Detailed Guide

Learn what construction interest expense is and how it affects your business.

Oct 29, 20233161 -

Banking

BankingComprehensive Capital One Bank Review (2022)

Most banks operate majorly as brick-and-mortar facilities, providing online services as a bonus. At Capital One, most transactions are online, so you would expect a sturdy and stable mobile banking service. This article focuses on this and more reasons why Capital One Bank stands out from the rest.

Jan 31, 20248758 -

Know-how

Know-howAll About Best Antivirus Software

Based on our testing and research, we handpick the products we think you'll find most useful, and we never let advertisers influence our choices. Please be aware that we may be compensated if you purchase after clicking on one of our links. Please read the disclaimer if you're curious about our advertising partners.

Feb 17, 20248140 -

Know-how

Know-howThe Finest Coverage Against Hurricanes

As a result of climate change, millions of people who live in hurricane-prone areas are experiencing more frequent and severe hurricanes. One storm in particular caused about $125 billion in damage, and the frequency with which this occurs shows no signs of decreasing. More than 7.1 million homes in the United States are susceptible to hurricane damage, said the Insurance Information Institute.

Oct 02, 20232550 -

Mortgages

MortgagesReview of American Debt Relief

Consumers can eliminate debt through American Debt Relief after paying a small portion of what they owe through a procedure known as debt settlement. Customers are urged to start setting aside a certain amount of money each month in a special savings account after speaking with a debt adviser throughout a free debt assessment. American Debt Relief will utilize the money to help pay creditors for less than what is owed once the necessary savings threshold is reached.

Dec 24, 20234225 -

Know-how

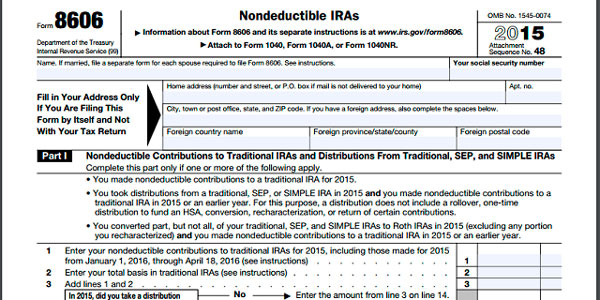

Know-howTime to File Form 8606

When you contribute sums to your traditional IRA that have already been taxed (contributions that are not deductible), you are required, as a general rule, to complete Form 8606 each year.

Oct 13, 20237093 -

Banking

BankingReview of American Express's Plum Card for 2022

To help you make better financial decisions, Bankrate is here. This post may include links to items from our business partners, but we take editorial integrity very seriously. Here's a breakdown of how we generate revenue. Even though the information on this page was correct at the time of publication, some of the deals featured here may have since expired. The deals on this website are subject to terms and conditions.

Jan 26, 20242158 -

Banking

BankingCan You Pay to Remove a Bad Credit Report? - Find Out How

Wondering if it's possible to pay to remove a bad credit report? Get the facts on this and other credit-related topics here.

Jan 11, 20249385 -

Banking

BankingWhat Exactly Is a Banknote?

It is usual for banknotes to be made of paper that may be exchanged for money. Cash and banknotes have a lot in common. Banknotes issued by the United States Treasury Department and distributed more by Federal Reserve are dollar bills. Banknotes in amounts of $1, $2, $5, $10, $20, $50, and $100 are used in the United States. Individuals can use cash in the form of banknotes.

Nov 04, 20234307 -

Know-how

Know-howWhat is a Non-profit Organization?

For the advancement of religious, scientific, benevolent, educational, intellectual, community security, or violence purposes, a nonprofit organization is exempt from paying taxes.

Oct 21, 20232184

-

Mortgages

MortgagesUnderstanding Pawnshop Loans: An In-depth Guide

Nov 29, 2023 -

Banking

BankingMoney Market Account vs. Savings Account: Which Should You Choose?

Jan 19, 2024 -

Mortgages

MortgagesWhy to Take Out a Personal Loan

Jan 02, 2024 -

Mortgages

MortgagesDebt-to-income Ratio for a Mortagage

Dec 26, 2023 -

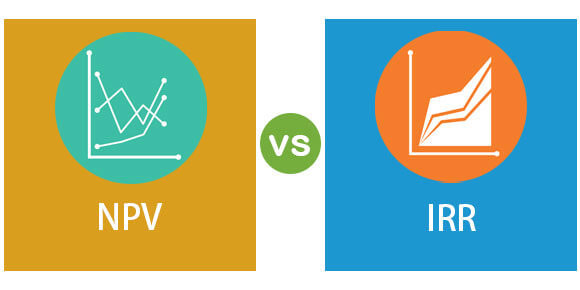

Investment

InvestmentReasons Why Successful Investing Is A Long-Term Game

Dec 16, 2023